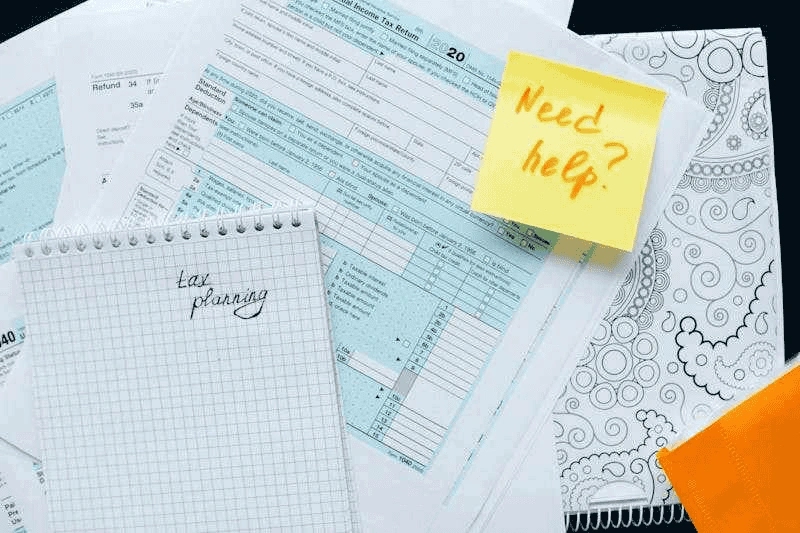

Master Tax Management with Real-Time Compliance Training

Learn how to manage Income Tax, GST, and TDS like a professional. This course gives you hands-on knowledge of taxation laws, e-filing returns, and real-time compliance — ideal for accountants, business owners, and tax consultants.

- Complete Income Tax & GST Filing Procedures

- TDS Deduction, Payment & Return Filing (Form 26Q, 16A)

- Practical Training on Income Tax Portal

- Computation of Taxable Income & Advance Tax

- Business Taxation, ITR-1 to ITR-5 Preparation

Next Batch

Starting 1st of Next Month

Duration

3 Months

Batch Size

Limited to 25 Students

Plan Your Career with Us

Our advisors will help you choose the right skills and roadmap.

Course Features

A practical training program designed to make you a proficient tax professional, capable of handling both direct and indirect taxation.

Course Curriculum

Our curriculum provides a comprehensive understanding of the Indian tax system, covering everything from the basics of Income Tax to the complexities of GST and TDS.

Intro to Taxation & Income Tax

- Overview of Indian Tax Structure

- The 5 Heads of Income

- Residential Status & Scope of Income

- Exemptions vs. Deductions

Advanced Income Tax & ITR

- Clubbing of Income & Set-off

- Computation of Total Income

- Filing ITR-1, ITR-2, ITR-3, ITR-4

- Understanding Form 26AS

Goods & Services Tax (GST)

- GST Concepts & Registration

- Input Tax Credit (ITC)

- E-Way Bill & E-Invoicing

- Filing GSTR-1 & GSTR-3B

TDS, TCS & Advanced Topics

- TDS on Salary & Other Payments

- TCS Provisions & Compliance

- Filing TDS/TCS Returns

- Tax Planning & Management

Why Learn Tax Management?

Taxation is a critical function for every business and individual, making skilled tax professionals highly sought after. This course provides a deep understanding of the Indian tax system, covering both Direct Taxes (like Income Tax) and Indirect Taxes (GST). You will learn practical skills in tax computation, return filing, and compliance, preparing you for a rewarding career as a Tax Consultant, Tax Analyst, or in corporate finance departments.

Master Direct & Indirect Taxes

Gain in-depth knowledge of Income Tax, including heads of income and deductions, as well as a comprehensive understanding of the Goods and Services Tax (GST) framework.

Practical Return Filing

Learn the end-to-end process of filing various tax returns, including Income Tax Returns (ITR), GST Returns (GSTR-1, 3B), and TDS/TCS returns, using official portals and software.

High-Demand Taxation Careers

Taxation expertise is always in demand. This course prepares you for lucrative roles like Tax Consultant, Corporate Tax Advisor, and GST Practitioner.

Why Learn Tax Management?